Be in charge of the way you grow your retirement portfolio by utilizing your specialized expertise and pursuits to speculate in assets that in good shape with all your values. Got knowledge in real estate property or personal fairness? Utilize it to help your retirement planning.

IRAs held at banking institutions and brokerage firms give constrained investment selections for their consumers mainly because they would not have the experience or infrastructure to administer alternative assets.

Sure, real estate property is one of our purchasers’ most popular investments, at times identified as a real estate IRA. Customers have the option to invest in almost everything from rental Houses, business real-estate, undeveloped land, home finance loan notes plus much more.

Number of Investment Choices: Ensure the company permits the categories of alternative investments you’re keen on, for instance real-estate, precious metals, or non-public equity.

At times, the expenses associated with SDIRAs may be bigger and a lot more complicated than with a regular IRA. It's because from the greater complexity related to administering the account.

Complexity and Responsibility: With the SDIRA, you've got far more Regulate about your investments, but You furthermore may bear extra obligation.

A self-directed IRA is really an extremely potent investment vehicle, but it’s not for everybody. Since the stating goes: with great ability arrives great obligation; and using an SDIRA, that couldn’t be more real. Keep reading to know why an SDIRA may well, or won't, be for you personally.

Quite a few buyers are shocked to discover that using retirement money to take a position in alternative assets has long been feasible considering that 1974. Having said that, most brokerage firms and banks target presenting publicly traded securities, like Click Here shares and bonds, because they deficiency the infrastructure and expertise to manage privately held assets, such as real estate or non-public fairness.

Set only, when you’re hunting for a tax productive way to construct a portfolio that’s more personalized to the interests and abilities, an SDIRA may be the answer.

In advance of opening an SDIRA, it’s essential to weigh the likely benefits and drawbacks according to your unique fiscal objectives and possibility tolerance.

Opening an SDIRA can provide you with entry to investments Usually unavailable through a lender or brokerage organization. Listed here’s how to start:

The tax rewards are what make SDIRAs beautiful For lots of. An SDIRA can be equally conventional or Roth - the account sort you end up picking will count mostly with your investment and tax approach. Check out using your fiscal advisor or tax advisor should you’re Not sure that's most effective in your case.

Think your Close friend is likely to be starting up the subsequent Facebook or Uber? Having an SDIRA, you could spend money on brings about that you think in; and perhaps take pleasure in increased returns.

This includes being familiar with IRS restrictions, handling investments, and staying away from prohibited transactions that may disqualify your IRA. A lack of data could end in high priced errors.

Consequently, they have a tendency not to market self-directed IRAs, which offer the flexibleness to take a position inside of a broader array of assets.

Simplicity of use and Technology: A consumer-helpful System with on line resources to track your investments, post documents, and regulate your account is important.

Higher investment selections suggests you are able to diversify your portfolio over and above stocks, bonds, and mutual cash and hedge your portfolio from current market fluctuations and volatility.

Transferring funds from one form of account to a different style of account, like relocating cash from a 401(k) to a conventional IRA.

As you’ve observed an SDIRA provider and opened your account, you might be questioning how to truly start investing. Knowledge the two The foundations that govern SDIRAs, along with the best way to fund your account, will help Read More Here to lay the inspiration for just a future of thriving investing.

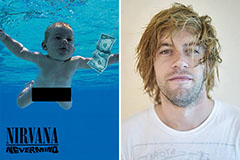

Spencer Elden Then & Now!

Spencer Elden Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!